In this edition of Graphic Intelligence, we show how deferring receipt of public pension benefits can make retirement planning cheaper for Canadians.

For each year of delaying take-up of C/QPP and OAS, the base benefit amounts increase. Delaying take-up of C/QPP from 60 to 70 increases base benefit amounts by 122 percent, and delaying OAS receipt from 65 to 70 increases them by 36 percent. However, for each year of delay, private savings must be consumed to replace the full amounts of public pensions that would have been received otherwise. This means delaying receipt of public pensions is only beneficial once the gains from greater C/QPP and OAS exceed the cost of additional private savings.

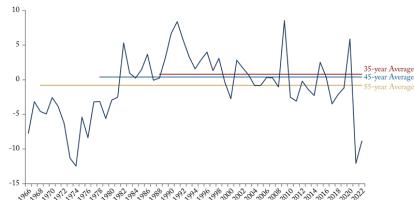

A person retiring at 60 and dying before age 84 would not gain from the higher payment amounts that result from the deferral. On the other hand, since most people live beyond the age of 84, this person may plan on having her retirement savings last longer, for example until the age of 94. In that case, delaying public pension take-up would considerably reduce her required savings rate during her career (from the blue line to the gold line).

Pension deferral is both an effective means of reducing the savings required overall and of lowering the cost of insuring against longevity.

To learn more about how pension deferral can make retirement cheaper and safer, read “Deferring Receipt of Public Pension Benefits: A Tool for Flexibility” by Antoine Genest-Grégoire, Luc Godbout, René Beaudry, and Bernard Morency.