From: Tracy Snoddon

To: Catherine McKenna, Minister of Environment and Climate Change

Date: October 19, 2018

Re: How Should Ottawa Distribute its Carbon Pricing Revenues?

Ottawa should rebate revenues from its carbon pricing backstop directly to citizens in non-compliant provinces that reject its plan. This option for returning backstop cash ensures government accountability is fair and flexible as I outline in my new C.D. Howe Institute E-Brief.

As the deadline for the federal government’s carbon pricing plan approaches, several provinces and territories are not yet in compliance with its requirements. Effective January 1, Ottawa intends to implement a minimum carbon price backstop in any non-compliant province or territory and promises to return the revenues to the jurisdiction where they are collected. The choice of how to do this is, however, still in flux.

The politics of carbon pricing may have changed, but the climate change challenge has not. As some provinces take a step back from carbon pricing, the federal government’s minimum-price backstop, and how it is deployed, is more important than ever.

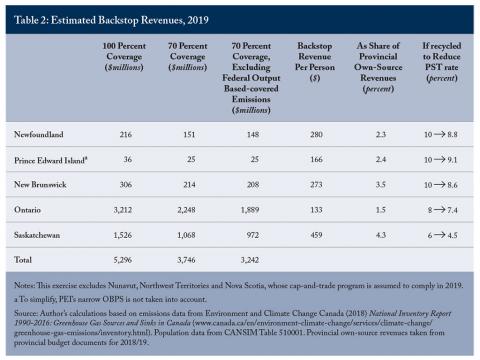

Ottawa has plenty of options for returning backstop revenues including cash grants to provincial and territorial governments, targeted federal spending, or equal per-capita rebates to the jurisdiction’s residents. Backstop revenues will be sizeable. As an example, I conservatively estimate that Ottawa would raise $2.8 billion in 2019 if the backstop was implemented in Ontario, Saskatchewan, New Brunswick, Newfoundland and Prince Edward Island. In Saskatchewan, for instance, estimated backstop revenues for 2019 translate into $459 per person and would be sufficient to lower the provincial sales tax rate in the province from 6 to 4.5 percent.

I recommend that:

- In provinces and territories that request the backstop, revenues should be disbursed revenues in accordance with the provincial government’s wishes.

- In a non-compliant province or territory, Ottawa should impose the backstop, but return the revenues as an equal per-capita rebate to residents. The per-capita rebate approach is preferable for several reasons; it minimizes intrusion in provincial fiscal matters, ensures government accountability, and helps to avoid returning the revenues in an arbitrary way.

- Rebating revenues to individuals reinforces the environmental, rather than revenue generation, purpose of carbon-pricing, which may reduce the risk of a successful future constitutional challenge to the backstop.

- A per-capita rebate addresses the distributional impacts from carbon pricing. Since rebates are allocated on a per-capita basis, a poor household will receive more, as a share of household income, than other households of a similar size.

Tracy Snoddon is Associate Professor, Economics, Lazaridis School of Business & Economics at Wilfrid Laurier University.

To send a comment or leave feedback, email us at blog@cdhowe.org.

The views expressed here are those of the author. The C.D. Howe Institute does not take corporate positions on policy matters.