Home / Publications / Alexandre Laurin – Reforming The Child Care Expense Deduction

- Intelligence Memos

- |

Alexandre Laurin – Reforming The Child Care Expense Deduction

Summary:

| Citation | . 2019. "Alexandre Laurin – Reforming The Child Care Expense Deduction." Intelligence Memos. Toronto: C.D. Howe Institute. |

| Page Title: | Alexandre Laurin – Reforming The Child Care Expense Deduction – C.D. Howe Institute |

| Article Title: | Alexandre Laurin – Reforming The Child Care Expense Deduction |

| URL: | https://cdhowe.org/publication/alexandre-laurin-reforming-child-care-expense-deduction/ |

| Published Date: | December 2, 2019 |

| Accessed Date: | November 1, 2025 |

To: Finance Minister Bill Morneau

From: Alexandre Laurin

Date: December 2, 2019

Re: Reforming the Child Care Expense Deduction

The Child Care Expense Deduction (CCED) allows eligible childcare expenses for an eligible child to be deducted from taxable income, in most cases on the return of the lower-income parent. In addition to a maximum claimable limit per child, low-income parents must contend with another limitation: the claim cannot exceed two-thirds of the earnings of that lower-income spouse; hence, the “two-thirds limit.”

Governments would significantly benefit families with greater needs if they lifted this limit up to the entire earnings of the lower-income parent.

The CCED stated objective is to recognize childcare costs incurred by parents in the course of earning employment income or pursuing education. The maximum dollar limits per child put a cap the cost of the measure. But the two-thirds limit is harder to justify: why limiting claims to a fraction of income earned from employment when the explicit goal of the deduction is to recognize childcare as a cost of earning income? And why two-thirds instead of one-half, three-quarters, or all of the earned income?

One feature of the two-thirds limit is that it disproportionately affects families at lower income levels. In 2019, about 40 percent of two-parent families claiming the CCED with family earnings under $50,000 are affected by the two-thirds-of-income rule, compared to only 5 percent of families above this threshold. Because of this, a substantial proportion of lower- and middle-income Canadian families are not able to fully deduct their childcare expenses.

The problem is greater in Ontario, in relation to the province’s new childcare tax credit, as highlighted in a recent FAO report. The amount of the Childcare Access and Relief from Expenses (CARE) tax credit is computed as a proportion (diminishing with family income) of childcare expenses claimable under the CCED, so the CARE credit is weirdly subjected to the two-thirds limit. The lower-income parent in a family sometimes has low or no tax liabilities so the two-thirds limit on the CCED may have limited tax consequences. On the other hand, the CARE credit is refundable (claimable regardless of taxable income) and therefore explicitly designed to compensate those families for whom the deduction has less value. The two-thirds limit runs counter to the objective of assisting lower-income families.

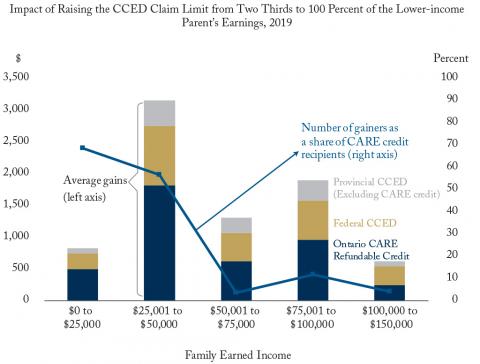

For the CARE credit alone, raising the claim limit from two-thirds to 100 percent of the lower-income parent’s earnings would benefit about six in 10 two-parent families earning less than $50,000. In total, about 30,000 families would gain an average of $1,000 in CARE credit. Further gains of about $600 federally in lower taxes and higher benefits on average due to lower taxable income, and $300 provincially, would put the total average gain for a gaining family in Ontario to nearly $2,000 – with the higher gains felt disproportionately in the $25,000 to $50,000 family income range (see Figure).

Outside Ontario, raising the two-thirds CCED limit would benefit another 70,000 families, but the average gain would be less than half that of Ontario’s families since other provinces do not have child care tax credits linked to the allowable CCED. Quebec families may opt to claim an income-tested provincial tax credit, but claimable childcare expenses are not linked to the CCED, and neither to the lower-income parent income.

Raising the claim limit from two-thirds to 100 percent of the lower-income parent’s earnings would greatly benefit a small number of families – disproportionately lower-income families – and would be relatively cheap. It would only cost the federal government about $40 million, less than 3 percent of the $1.4 billion cost of CCED. In Ontario, most two-parent lower-income families would benefit, so the cost of the CARE credit would increase by about 10 percent ($33 million) – still not a very large sum in relation to the overall cost of the program.

The federal government should raise the two-thirds of earnings limit to 100 percent of earnings of the lower-income parent. Failing that, Ontario should consider modifying the computation of its CARE credit to decouple it from the CCED’s two-thirds limit.

Alexandre Laurin is Director of Research at the C.D. Howe Institute.

To send a comment or leave feedback, email us at blog@cdhowe.org.

The views expressed here are those of the author. The C.D. Howe Institute does not take corporate positions on policy matters.

Note: Family earned income includes earnings from employment and self-employment, plus disability benefits. A supporting table providing extra details by family types and provinces, as well as fiscal costs, is available here.

Source: Author’s calculations using Statistics Canada’s SPSD/M, v. 27.1. Responsibility for use and interpretation lies with the author.

Related Publications

- Intelligence Memos