From: Ken Boessenkool

To: Bill Morneau, Minister of Finance

Date: May 15, 2020

Re: Ottawa has the tools to replace the CERB (Part I)

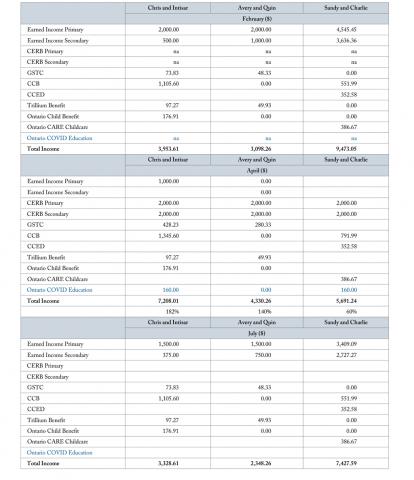

Canadian governments moved swiftly and massively to provide personal supports to Canadians during the COVID crisis. This Intelligence Memo looks at income from three families in February before the crisis hit, in April when generous federal and provincial supports hit their zenith, and in July when the employers of all of our families have taken advantage of the Canadian Emergency Wage Subsidy (CEWS) and are paying wages accordingly.

The purpose of the exercise is not to criticize what the government has done to date – clearly the government had to react quickly and decisively, and they did, with unanimous support – or to criticize families who received those hastily designed benefits. Rather the purpose is to foster debate around what type of supports the government might consider during the recovery phase – which will be the subject of subsequent Intelligence Memos.

Our first family is Chris and Intisar. Chris works on average 35 hours a week at McDonalds as a shift manager and made $500 per week in February. Intisar teaches piano two evenings a week at a local music store and typically makes $100 per week. Chris and Intisar have two children, ages two and four. Their total family income in February, including federal and Ontario child benefits, Goods and Services Tax Credit (GSTC) and Trillium benefits totalled just under $3,400.

Our second family is Avery and Quinn. Avery is a bartender and made $500 per week in February and Quinn works at the Koodo kiosk at the mall and made $250 per week in February. They have no kids. Their total family income in February was just under $3,100.

Our third family is Sandy and Charlie. Sandy is a restaurant manager at the Keg and makes almost $55,000 and Charlie manages a high-end hair salon and earns just shy of $44,000. They claimed the full $16,000 in childcare expenses for their two children, aged three and five which reduces their federal tax by $3,358 and they get $4,640 in Ontario CARE benefits. Including these amounts, their family income was just shy of $9,500 in February.

All six of these individuals lost their jobs in mid-March and applied for the Canada Emergency Response Benefit (CERB) of $500 per week. Chris managed to keep a few shifts at McDonalds running the drive-thru and averaged $250 per week through April – but remained below the $1,000 threshold at which he would lose his CERB.

In normal times, Employment Insurance (EI) would have paid 55 percent of eligible earnings so Sandy would have received an EI benefit of $2,500 a month, not the $2,000 received on CERB.

The first two families would also receive supplemental GSTC cheques that doubled their current annual benefit. And the two families with kids would see an additional $300 per child. Plus the Ontario Ministry of Education provided $200 per child in April.

If we spread these supplemental amounts over March 15 to May 31 then Chris and Intisar saw their family income rise in April to just shy of $7,500 while Avery and Quinn saw a more modest increase to just over $4,300. Sandy and Charlie saw their family income drop to just under $6,000.

The CERB is taxable, so our first two families would see their tax bill rise next April. Our third family would pay less tax – but also save on childcare expenses. But that’s down the road, for now the table reflects the “cash in hand” that these families would see. As such, it assumes no mid-year adjustments to existing supports.

Jump ahead to July. All of the employers of our couples have applied for and received the CEWS that pays 75 percent of the salary bill of Candian firms. All of our family members are now working at their former jobs at 75 percent of their former salary. All other family and sales tax benefits return to what they were in February as these benefits do not change mid-year.

In a companion Intelligence Memo, we examine what kind of programs are needed for this recovery to be sustainable for Canadian families.

Ken Boessenkool is an independent public policy economist

To send a comment or leave feedback, email us at blog@cdhowe.org.

The views expressed here are those of the author. The C.D. Howe Institute does not take corporate positions on policy matters.