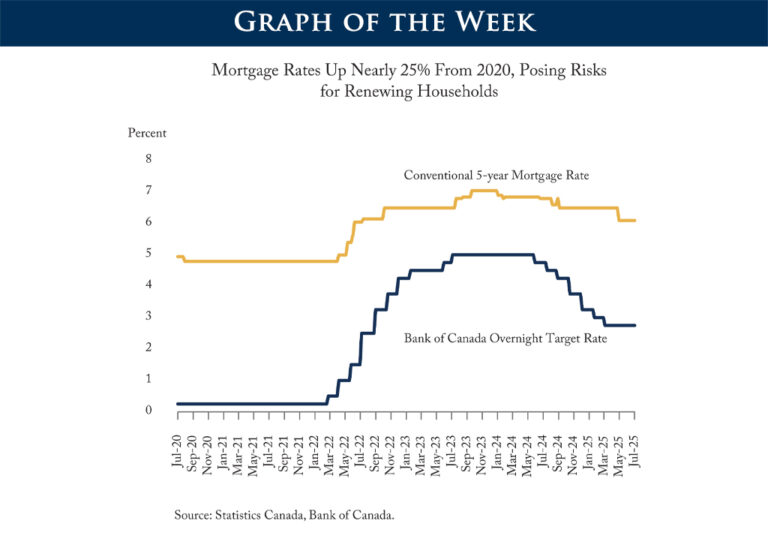

When the Bank of Canada buys Government of Canada bonds from commercial banks, it adds them to the asset side of its balance sheet and pays for them by adding to the banks’ deposits (settlement balances) on the liability side of its balance sheet. As a result, the Bank’s balance sheet gets bigger.

Amid rising interest rates, the variable interest it pays banks on those deposits exceeds the average of the fixed rate it earns on the bonds from the Government of Canada. The Bank incurs a net income loss (Figure A). When the reverse is true, the Bank has a net income gain (Figure B). Figure A represents the situation the Bank finds itself in today.

When this occurs, the Bank draws down its reserve funds and equity. However, the size of expected losses will push equity negative. This does not directly impede the Bank’s ability to conduct monetary policy. However, trouble looms if the public believes the Bank is keeping the deposit rate lower than is necessary to hit the 2 percent inflation target to keep equity falling further negative.

Our preferred solution to this problem is for the Bank to instead enter these losses as a deferred asset on its balance sheet and a deferred liability on the government’s balance sheet. This would avoid negative equity for the Bank altogether and make it clear that the Bank must eliminate its deferred asset position before remitting profits again to the government.

This step would require a change to the Bank of Canada Act – a change that will increase transparency, ease communication with the public, and, as a result, safeguard the Bank of Canada’s independence.

Read The Consequences of the Bank of Canada’s Ballooned Balance Sheet for more.