From: Eloise Duncan

To: Provincial Policymakers

Date: March 21, 2023

Re: Financial Resilience Index Highlights Provincial Differences: Quebec a Leader

A little over a year ago, I highlighted the importance of understanding household financial resilience at a granular level in order to support a sharpened policy aim.

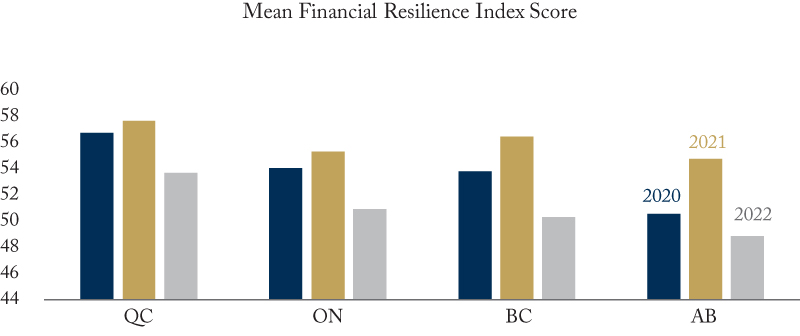

This continues to be true as the Financial Resilience Institute’s Financial Resilience Index shows significant differences in household financial resilience by province. Based on the June 2022 Financial Resilience Index (our most recent data), Quebec tops the charts with a mean financial resilience score of 53.74, significantly higher, for example, than Alberta at 48.87 and Saskatchewan at 44.63.

Digging deeper highlights the need for nuanced thinking on how the rate-hike cycle over the last year is likely to continue to play out.

Economic growth in Quebec was strong in 2021 and this continued into 2022 with high savings rates and robust wage growth. The province experienced strong household financial resilience with key Index indicators such as the liquid savings buffer higher than either Ontario or Alberta, alongside lower financial stress indicators.

Social policies in Quebec, such as universal daycare (which support families with their essential expenses) might have a positive impact on financial stress indicators, supporting a household’s financial resilience. Debt manageability in Quebec was a problem for only 18 percent of the population in June 2022, lower than any other province. Additionally only 51 percent of Quebec households reported rising interest rates were a problem for them personally as of June 2022, significantly lower than the national 61-percent number.

Despite Quebecers’ financial resilience, they, like the rest of Canadians, are not immune to the rising cost of living, with the Index showing 42 percent of households in the province drew down savings over the 12 months to June 2022, and 87 percent agree that the increase in the cost of living has outpaced any income growth in their household.

In Alberta, the mean provincial financial resilience score was 48.87 in June 2022, a noticeable drop to the 54.81 in June 2021 and 50.56 in June 2020. Sixty-two percent of Albertans in June 2022 were living paycheque to paycheque compared to only 35 percent of those in Quebec. The decline in the proportion of households reporting un-manageable debt levels – down to 25 percent last June from 32 percent in June 2020 – was heartening. But 35 percent of Albertans still increased their borrowing to pay for essential expenses. And the Index shows an increase in Albertans that have drawn down on their savings (from 37 percent to 53 percent) between June 2020 and June 2022. Of note as we look ahead to the 2023 Indexes may be the effect higher oil and gas revenue will have on Albertans’ balance sheets.

Moving west, the provincial mean score for British Columbia took a hit in June 2022 falling to 50.35, compared to 56.50 in June 2021 and 53.82 in June 2020. Sixty-two percent of British Columbians reported that housing affordability was a problem for them personally as of June 2022, up from 53 percent two years earlier (similar to Ontario at 58 percent, well above Quebec at 41 percent). Debt manageability was a challenge for 25 percent of British Columbians as of June 2022. Twenty-nine percent of British Columbians had a liquid savings buffer of less than three weeks, significantly up from 19 percent two years earlier.

In our most populous province, Ontario, the story is the same, as its mean financial resilience score of 50.93 in June 2022 was a significant drop from 55.36 in June 2021 and 54.07 in June 2020.

In June 2022, 47 percent of Ontarians reported having drawn down on their savings over the past 12 months, up from 30 percent in June 2020. Of concern, in June 2022, 24 percent of Ontarians reported their household was unable to meet their essential expenses – higher than any other province. Forty-three percent reported their household was facing significant financial hardship, significantly higher than the 29 percent of households in Quebec.

We are left with a similar narrative across the country with concern among households over their financial resilience. There may be challenges for some households in the February 2023 Index due to steady monetary policy tightening over the last year. That said, nuance remains, with certain provinces appearing to be in better shape, such as Quebec, than others, such as Ontario. Tracking household financial resilience by province can support policymakers in creating more targeted policies and impact measurement for their local economies and citizens.

Eloise Duncan is CEO and Founder, Financial Resilience Institute.

To send a comment or leave feedback, email us at blog@cdhowe.org.

The views expressed here are those of the author. The C.D. Howe Institute does not take corporate positions on policy matters