From: Thorsten Koeppl and Jeremy M. Kronick

To: Canadian Securities Regulators

Date: December 19, 2018

Re: How to Regulate Initial Coin Offerings

Given the boom in, and media attention surrounding, Initial Coin Offerings (ICOs), one relevant question is whether this new type of financing fills a market gap in the financial sector, or is just a way of defrauding unsuspecting retail investors looking to invest in new startups.

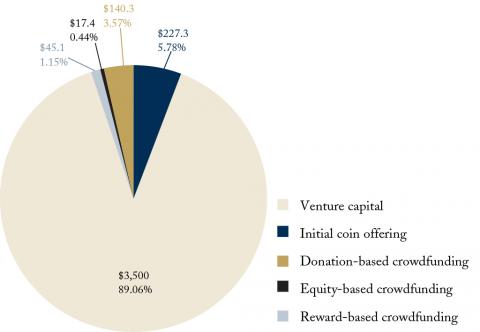

In our recent C.D. Howe Institute Commentary, we set forth arguments showing that ICOs do indeed fill an essential gap in funding for entrepreneurs that have limited access to other forms of startup financing such as crowdfunding, venture capital or bank lending. For an ICO to be the efficient way of financing, the business venture needs to develop:

- a decentralized platform, usually based on blockchain technology; where

- a coin gives digital access to the platform; and serves as

- a means of payment for users that engage in decentralized, person-to-person (P2P) exchange in order to create and transfer value between them.

If these features are fulfilled – and a sufficient amount of coins are retained by the issuer so that incentives exist for the issuer to invest in the proper development of the blockchain-based platform - using an ICO can be integral to the project’s success, and we label it simply a “fundamental ICO.”

Based on such guidance, and very much in the spirit of “activity-based regulation,” we suggest that Canadian securities regulators develop specific regulations for ICOs that move beyond the question of whether an ICO is a security or not and take into account the special nature of such financing.

Alternatively, or until new rules arrive, regulatory relief could still be granted for fundamental ICOs under the Canadian Securities Administrators (CSA) Sandbox.

Our proposed test can also create guidelines for the right approach to taxation that is consistent with the value that is added by such financing. Tax rules can be based on the dual roles of the coins, which are both an investment stake and a currency.

There is value in bringing together economic, regulatory and legal aspects to develop a specific framework for the regulation and taxation of ICOs in Canada. This can ensure an environment that reaps the benefits of the ongoing blockchain revolution for the Canadian economy without exposing investors unnecessarily to fraud.

Thorsten Koeppl is Professor and RBC Fellow in the Department of Economics at Queen’s University and Scholar in Financial Services and Monetary Policy at the C.D. Howe Institute. Jeremy M. Kronick is Associate Director, Research, at the C.D. Howe Institute.

To send a comment or leave feedback, email us at blog@cdhowe.org.

The views expressed here are those of the authors. The C.D. Howe Institute does not take corporate positions on policy matters.