January 21, 2021 – Outdated practices make the budgets of too many Canadian cities impossible for non-experts to understand, says a new report from the C.D. Howe Institute.

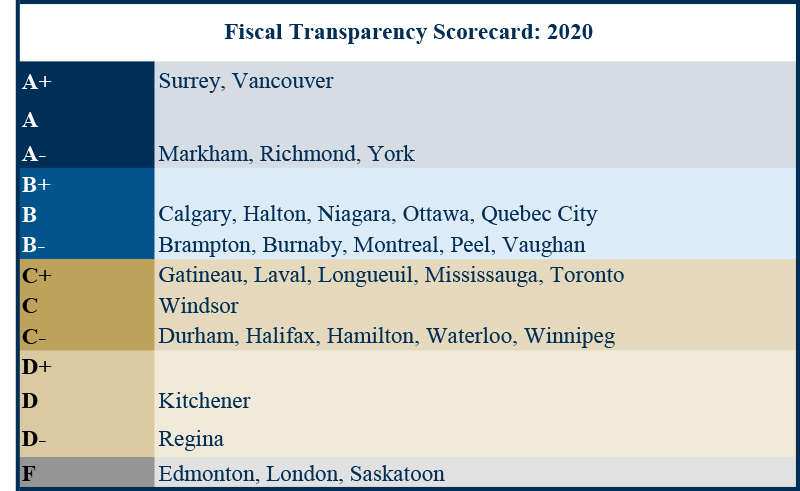

In “Time for an Upgrade: Fiscal Accountability in Canada’s Cities, 2020,” authors William B.P. Robson and Miles Wu grade the clarity, comprehensiveness, and timeliness of the financial presentations of 31 major Canadian municipalities, based on their most recent budgets and financial statements, and prescribe some simple fixes to help the poor performers.

“Opaque and late budgets impede accountability,” said Robson. “Simple information, such as how much the municipality plans to spend this year, or how its spending plan this year compares with the previous year’s plan, can be hard even for experts to find.”

This C.D. Howe Institute annual report card grades the financial presentations of 31 major Canadian municipalities based on their most recent budgets and financial statements. Of those 31, Edmonton, Saskatoon and London sadly earn Fs, failing to meet a minimal standard of transparency, usefulness and timeliness. Happily, Vancouver and Surrey garner A+s for clarity and completeness. Markham, Richmond, and York Region also stand out favourably, each earning an A-. Elsewhere, Toronto garnered a C+, while Calgary, Niagara, Ottawa, and Quebec City each earned a B grade.

The report urges municipal governments to present budgets using the same public sector accounting standards (PSAS) and format they use in their year-end financial statements. One key consequence of this change would be that municipal budgets would use accrual accounting with respect to capital, recording revenues and expenses as assets deliver their services, rather than focusing on upfront outlays of cash, which the authors argue would help cities plan and pay for infrastructure.

“The COVID-19 crisis and its impact on the revenues and expenses of all governments will make the fiscal capacity of Canada’s municipalities a pressing topic for years to come,” added Robson. “All the more reason for municipalities to give Canadians a clearer view of how they tax, spend and invest.”

For more information contact: William B.P. Robson, CEO; Miles Wu, Research Assistant; or David Blackwood, Communications Officer, the C.D. Howe Institute, 416-873-6168, dblackwood@cdhowe.org

The C.D. Howe Institute is an independent not-for-profit research institute whose mission is to raise living standards by fostering economically sound public policies. Widely considered to be Canada's most influential think tank, the Institute is a trusted source of essential policy intelligence, distinguished by research that is nonpartisan, evidence-based and subject to definitive expert review.