From: Alexandre Laurin and Benjamin Dachis

To: Finance Minister Bill Morneau

Date: May 20, 2020

Re: A stimulus plan to restart the job market

As governments partially lift their restrictions and economic activity resumes, many more employees will soon be asked to return to work, and new work opportunities will arise for the unemployed.

Many people may hesitate to return to or to accept work. Health-related concerns are top of the list, of course. But in other cases, employers are learning that some may prefer receiving the Canada Emergency Response Benefit (CERB) to working. As governments look to economic stimulus for the recovery while also creating fairer supports across the labour force, they should look to the Canada Workers Benefit (CWB) as the main tool.

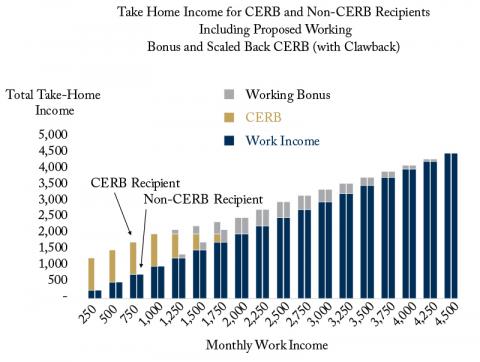

One way to encourage unemployed workers to return to a job before their four-month CERB ends, is to let them keep a declining amount of the CERB up to a maximum earnings threshold. That, along with reducing the CERB amount (for example, to about $1,000 a month), should also be a feature if the government extends CERB eligibility to cover those who do not qualify for Employment Insurance (EI) and have not returned to work when the 16-week eligibility period ends. That is early July for many.

One major problem with an income-tested CERB is the unfairness it creates between those who ceased to work and those who kept working during the crisis while not collecting the CERB (earning more than $1,000 per month). Those returning to work would have their income supplemented by a reduced CERB, while those earning the same income who kept working would not. This would violate the fiscal policy principle that individuals with similar income and characteristics should be treated the same by the tax and transfer system.

An announcement on May 7 that the federal government will co-fund provincial essential worker bonuses is a potential start to a fairness solution. But a better design is needed for the economic restart.

The CWB already performs the function of supplementing the income of low-wage individuals and families. The CWB, an “earned-income” refundable tax credit, provides a financial incentive for unemployed low-income individuals to enter and remain in the workforce. The value of the benefit increases with income, up to a maximum. Most single individuals can receive up to $1,355 ($2,335 for families) which is gradually reduced when net income exceeds $12,820 ($17,025). Provinces have the ability to modify the parameters of the CWB for their residents.

A temporary “Working Bonus” for low-wage workers could cover, say, the months of June, July, and August. It could pay, say, a maximum of $500 per month per worker. The design would be inspired by earned-income credits like the CWB, but the Working Bonus would be administered separately. To be eligible, workers would need to earn from employment or self-employment at least $1,000 per month. It could be phased in at a rate of 50 cents per dollars of earnings, such that the maximum monthly benefit amount would be reached at monthly earnings of $2,000. The monthly supplement could then be clawed back at a rate of 25 cents per dollar of earnings past the $2,500 monthly earnings mark.

*Note: Revised CERB assumes a $1,000 monthly amount and a $1:$1 clawback on the benefit amount with work earnings.

Because the amount of the bonus increases with earnings at the lower end of the income spectrum, it would encourage them to work more, supporting the economic re-opening. The national cost for this support program would be in the ballpark of $3 billion. A more generous program would provide stronger work incentives, but would add to the fiscal cost.

Normally, a person or family’s CWB benefit is based on the previous year’s net income. Our proposal is to base the working bonus on expected monthly earnings (same basis as the CERB) this summer starting early July. The new Working Bonus would use the trust but verify approach of CERB, which is already income tested on a monthly basis.

This Working Bonus, because it can be targeted to non-CERB recipients, would complement the CERB. If Ottawa expands the CERB to allow recipients to earn more than $1,000 per month and keep an income-tested reduced amount, as suggested in the chart above, the CWB would preserve work incentives while allowing for the CERB to wind down.

Another option to focus on fairness within a company would be for Ottawa, subject to addressing technical hurdles, to target the Working Bonus to those not able to return to a previous job at the same hours and pay and letting them continue claiming an income-tested CERB. This would provide a top-up to workers in sectors that have no path to re-opening to seek work in other – lower-paid – areas with job openings. Ottawa would need to create supporting documentation and administration and handle similar implementation hurdles around those with multiple jobs.

Our proposal would encourage people to work more or take on a new job when restrictions are lifted and is targeted to the lowest-income workers hurt most in this recession. It should be the centrepiece of a plan to restart the job market.

Alexandre Laurin is Director of Research at the C.D. Howe Institute and Benjamin Dachis is its Director of Public Affairs.

To send a comment or leave feedback, email us at blog@cdhowe.org.

The views expressed here are those of the authors. The C.D. Howe Institute does not take corporate positions on policy matters.