From: William B.P. Robson and Nick Dahir

To: Canadian Taxpayers

Date: September 21, 2022

Re: It’s Fall – Time Governments Told You Where Your Money Went

We are more than half-way through September. The fiscal years of Canada’s senior governments ended almost six months ago.

If these governments were companies listed on Canadian stock exchanges, rules for transparency and accountability to the investors who voluntarily own their shares would have obliged them to publish their financial statements before the end of June.

Governments have greater power than listed companies to take our money and do whatever they want with it, but they are much slower to show the people whose money they use how and how much they taxed, spent and borrowed.

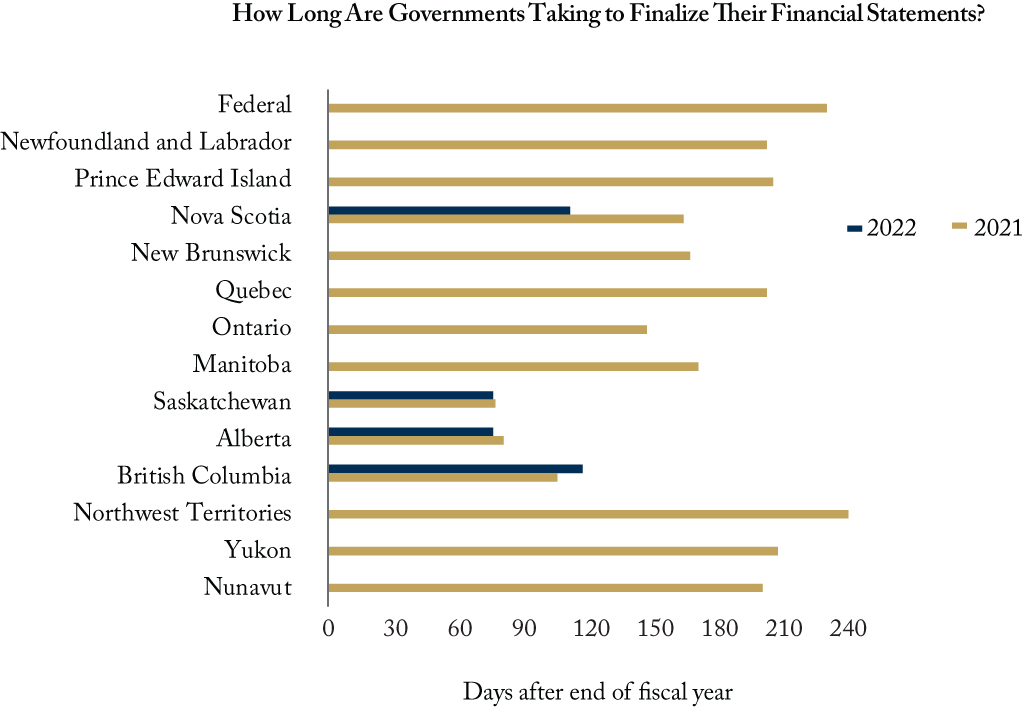

To date, only four governments – Alberta, British Columbia, Saskatchewan, and Nova Scotia – have released public accounts for 2021/22, the fiscal year that closed March 31.

This sluggish performance is troubling, as we outline in our new C.D. Howe Institute study. The public accounts of federal, provincial and territorial governments are essential for citizens, and legislators who represent them, to understand what these governments are doing, and to hold them accountable. Timely gathering and release of information matters in its own right. Moreover, the budgets these governments presented around the start of the fiscal year made headlines and triggered votes of confidence. After the year is done, it is no less important to see what happened – in particular, to see how their results differed from what their budgets led us to expect.

Over the 20 years preceding the pandemic, governments tended to collect more revenue than they projected in their budgets, and spend more than they projected in their budgets.

Governments’ response to COVID-19 boosted their spending and borrowing to unprecedented levels, which makes monitoring their stewardship of public money more pressing than ever. If we find problems, we should hold finance ministers accountable before the next budget round grabs our attention, and failures to deliver on previous promises become old news.

Not surprisingly the senior governments that have already published their 2021/22 financial statements have a better past record than the ones that have not. By this time last year, using the dates when the relevant auditor general signed the statements as a reference, only Alberta, British Columbia, Ontario, and Saskatchewan had finalized their statements (see Figure). Nova Scotia, New Brunswick, and Manitoba released their financial statements before the end of September last year. Nunavut, Newfoundland and Labrador, Quebec, Prince Edward Island, Yukon, the federal government and the Northwest Territories finalized their financial statements more than six months after the end of the fiscal year.

The federal government’s late presentation of its results for 2020/21 was particularly regrettable. It is the largest and most influential of the group, and its spending and borrowing ballooned with the pandemic. It never presented a budget that year – an unprecedented failure. Then, in another unprecedented move, it reopened the books for 2020/21 after the Auditor General had signed off in September. The second sign-off from the Auditor General did not occur until November, and the Public Accounts themselves did not appear until the middle of December. The government that should be setting the highest standard for transparency and accountability is nowhere close.

We can hope to see the federal government, and Nunavut, Newfoundland and Labrador, Quebec, Prince Edward Island, Yukon, Northwest Territories, Nova Scotia, New Brunswick and Manitoba, release their results soon. Looking further ahead, no government should publish its results later than six months after the end of the fiscal year – indeed, there is no reason why all governments should not publish within three months, as Alberta and Saskatchewan do. Timelier financial reporting will improve Canadians’ ability to hold their governments accountable for their taxing, spending, and borrowing. The fiscal impact of COVID-19 has raised the stakes. Better is always possible, to borrow a familiar phrase. Canadian taxpayers need better here.

William B.P. Robson is CEO of the C.D. Howe Institute, where Nicholas Dahir is a Research Assistant.

To send a comment or leave feedback, email us at blog@cdhowe.org.

The views expressed here are those of the authors. The C.D. Howe Institute does not take corporate positions on policy matters.