The Study In Brief

Auto insurance premiums in Canada amount to about $27 billion per year. For most Canadians, auto insurance represents a significant yearly expense. Provincial and territorial governments control auto insurance, which is mandatory across Canada. Some provinces deliver the insurance themselves through a government agency. Others outsource delivery to private-sector insurers. A recent C.D. Howe Institute study (Campbell and Omran 2021) concluded that Canadians appear to pay the highest premiums in the world for auto insurance relative to GDP. This paper proposes policy changes governments should adopt to reduce the cost and improve the value of auto insurance in Canada. Insurance premiums vary considerably among provinces. Our review shows that the premium for personal injury coverage is the most significant contributor to the overall differences. We find that personal injury coverage is, on average, four times more expensive in provinces where the private sector delivers the insurance than in the provinces with government delivery systems, even though the government systems offer greater benefit entitlements for personal injuries. The paper explores in detail why this is happening.

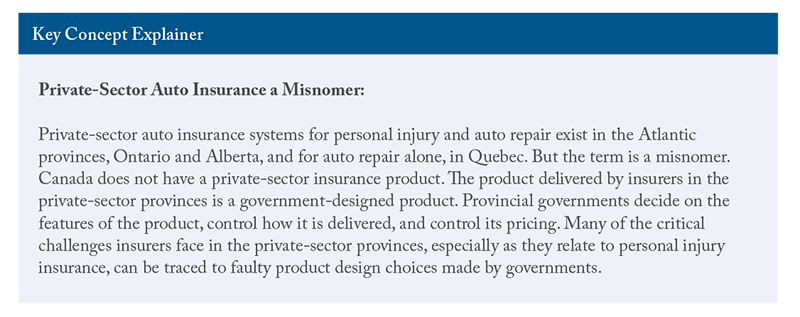

The government insurance systems for personal injury coverage have the natural advantages of being single-payer, empowered systems that do not allow lawsuits for medical claims. On the other hand, we don't have a truly private-sector auto insurance product to compare with the government-run systems. The product delivered by insurers in the private-sector provinces is a government-designed product. Provincial governments decide on the features of the product, control how it is delivered, and control its pricing. The product is highly inefficient and has many poor design features, which cause it to be wasteful and unnecessarily expensive.

In effect, the advantages of competitive private-sector market forces have been sacrificed by governments for other priorities. This situation robs consumers of good value for their insurance dollars. Despite the current advantages enjoyed by government insurance, we conclude that it would be inappropriate for the private-sector delivery provinces to switch to government insurance. Government auto insurance has its challenges and problems. First, there is a risk that at some point, governments will interfere through their agencies to pursue political goals that will distort the price/value of the insurance product. The future of consumer services, like insurance, lies in being responsive to rapid changes in consumer needs, pricing and innovation, qualities which governments are poorly suited to deliver.

This paper makes policy recommendations for governments with private-sector auto insurance delivery systems, including a series of product reform recommendations to significantly improve value for money. The recommendations increase consumer choice and show how to reduce the propensity to file claims and mitigate fraud. Notably, the recommendations include suggestions for minimizing the disputes that drive the high transaction costs in today's systems. The report also recommends that governments address auto repair fraud and potential restrictive trade practices by auto manufacturers, which increase costs to consumers.

The report concludes that there is no valid reason why governments should perpetuate the expensive and wasteful auto insurance regimes they have designed in the private-sector delivery provinces. Sensible solutions exist that will save consumers substantial sums each year, reduce disputes and provide much better value.

The author thanks Jeremy Kronick, Benjamin Dachis, Charles DeLand, Alex Laurin, Mark Zelmer and several anonymous reviewers for comments on an earlier draft. The author has provided consulting services for the Financial Services Regulatory Authority of Ontario, a provincially owned auto insurance company, and private sector auto insurance companies. He retains responsibility for any errors and the views expressed.

Introduction

Auto insurance premiums in Canada amount to about $27 billion per year. For most Canadians, it represents a significant yearly expense.

Auto insurance is controlled by provincial and territorial governments and mandatory across Canada. Some provinces deliver auto insurance for personal injury and auto loss or repair themselves through a government agency (Manitoba, Saskatchewan and BC). Others outsource delivery to private-sector insurers (the Atlantic provinces, Ontario and Alberta). Quebec delivers personal injury insurance through a government agency and auto loss or repair insurance through private-sector insurers. A recent C.D. Howe Institute study (Campbell and Omran 2021) concluded that Canadians appear to pay the highest premiums in the world for auto insurance relative to GDP. The price for auto insurance among different countries depends on many factors; for example, the extent to which government social safety nets cover the medical and income replacement needs of an injured person. While affordability is important, comparing the average price of an auto insurance policy doesn’t tell us about the value the policy delivers.

Within Canada itself, where there is a fair degree of uniformity in the provincial social safety nets, there is still a wide variance in the cost of auto insurance among provinces. This paper proposes policy changes governments should adopt to improve the auto insurance cost/value equation in Canada. The paper will define good value in an auto insurance system, identify the sources of high claims cost amongst the different provinces, compare value propositions and make recommendations for change. Finally, we comment on whether government or private-sector delivery is preferable.

We refer to government and private-sector auto insurance systems throughout the paper. The latter term, strictly speaking, is a misnomer. Canada does not have a private-sector insurance product. The product delivered by insurers in the private-sector provinces is not the result of consumer choice or market forces. In all cases, provincial governments design the product, control how it is delivered, and control its pricing. As we shall see, many of the critical challenges insurers face in the private-sector provinces, especially as they relate to personal injury insurance, can be traced to faulty product design choices made by governments.

Auto insurance covers the cost of personal injury, damage to, or replacement of, an automobile and third-party liability insurance. Every province and territory requires drivers, by law, to carry some form of automobile insurance. However, how much and what type of insurance drivers must carry varies considerably.

Figure 1 shows a ranking, provided by the Insurance Bureau of Canada, of the average cost of auto insurance by province in 2019, before the COVID pandemic. As you can see, the average price for Quebec is $800 while it is $1,600 in Ontario and even more in BC. However, the benefit coverage provided by the policies in each province differs significantly.

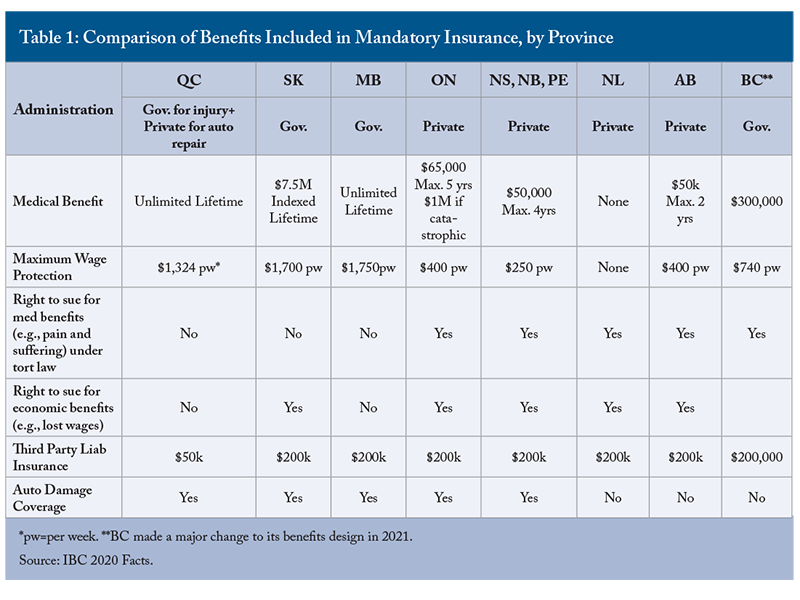

Table 1 shows the mandatory benefit coverage required in each province. As we can see, there is wide variance among the provinces. Coverage ranges from unlimited lifetime personal injury coverage on a no-fault basis in most of the government-run systems, to limited coverage in the private-sector delivery systems; and from fairly generous wage loss protection in the government systems, to wage loss protection that is less than the minimum wage in the private-sector delivery systems.

While drivers must carry the mandatory insurance in their province, they can buy additional insurance on an optional basis. Given the wide variability of compulsory insurance among provinces, it is not possible to compare the respective value provided simply by looking at the average prices of their premiums. In the following sections, we propose criteria for a good insurance regime. We then review (through a mechanism of normalizing coverage as much as possible) the value delivered by different provinces.

Good Value in Auto Insurance

Ideally, auto insurance should do a few basic things well:

- It should protect a driver from liability against damage caused to an innocent third party.

- It should provide adequate protection against the cost of repairing one’s car after an accident or replacing a stolen car.

- Given existing social safety nets, the auto policy should provide appropriate protection against any additional financial and medical consequences of an injury not already covered, particularly for a severe or catastrophic injury.

- Insurance should be affordable, simple to understand, readily available and easy to access.

- It should allow drivers to adjust the coverage based on their needs.

Importantly, drivers should have confidence that the system is fair; that there is a minimum of fraud or wasteful expenditure. Finally, for some citizens, the ability to sue an at-fault driver for damages is an important issue. However, as we shall see, the cost of allowing lawsuits often outweighs the benefits as a whole.

From a consumer perspective, the value proposition in auto insurance is very sensitive to price. In almost every case, governments change or adjust the mandatory insurance in their province when citizens complain about the price.

General Unhappiness with the Current Systems in Many Provinces

BC, Alberta, Ontario, Newfoundland and Nova Scotia have all either commissioned studies, or taken steps (or plan to take steps) to deal with rising auto insurance costs. The IBC Report “2020 Facts of the Property and Casualty Insurance Industry in Canada” provides a survey of major issues confronting several provincial auto insurance systems. The central issue is the rising cost of premiums.

Because having auto insurance is mandated by law, citizens look to provincial governments for relief when premiums rise or it gets difficult to find affordable insurance. Governments have reacted by reducing benefits, increasing regulations, changing the mix between no-fault and tort, restricting the ability to sue at-fault drivers, and capping rates. In a paper, Mary Kelly, Anne Kleffner and Si Li

Contributors to Price and Value – A Deeper Drive

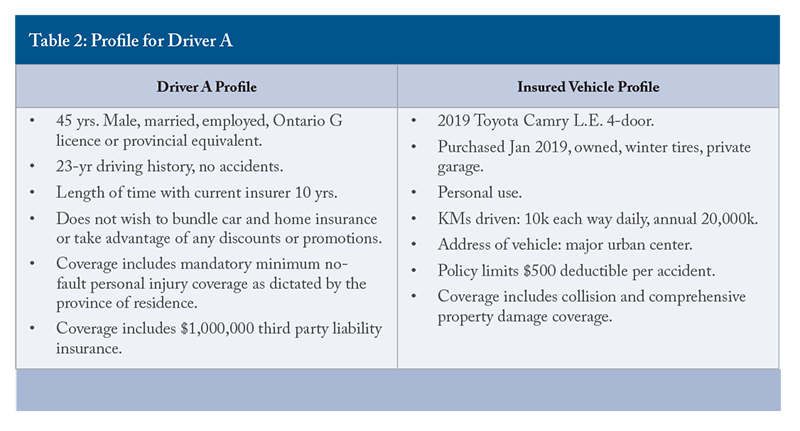

To help compare value delivered, we attempted, as far as possible, to normalize the insurance benefits and costs in each province. We sought quotes from a leading insurer in 2021 for premium costs for similar coverage in selected provinces, using the same insurer across the provinces to avoid differences in risk tolerance among insurers. In addition, we used a typical driver and car profile (see Figure 2). For comparison purposes, we picked three government-run systems – Quebec, Saskatchewan and Manitoba – and three private-sector delivery systems – Newfoundland, Ontario and Alberta.

Collectively, these provinces account for just over 80 percent of Canada’s population. We excluded the government-run system in BC, long acknowledged to be the most expensive system for auto insurance in Canada because BC completely changed its system from a predominantly tort to a predominantly no-fault system starting in 2021. In this respect, the BC system before the change was much closer to a private-sector delivery system and was not comparable to the government-run systems in Quebec, Manitoba and Saskatchewan.

We could not completely normalize the premium price for personal injury coverage. For example, it was not possible to price unlimited, lifetime medical coverage in provinces that did not offer it, while others did. However, we were able to normalize important details governing premium costs, namely the age, comparable address (major urban centers were used vs rural), the driving history of the insured driver, the vehicle model and age, annual kilometres driven, and the level of collision and third-party liability coverage included in the policy. While not perfect, the information gathered provides essential insights into what influences relative premium costs in various provinces for a similar driver and car profile and informs the potential development of policy options. We call our hypothetical consumer driver A (see Table 2). The normalized annual premiums for driver A are summarized in Figure 2.

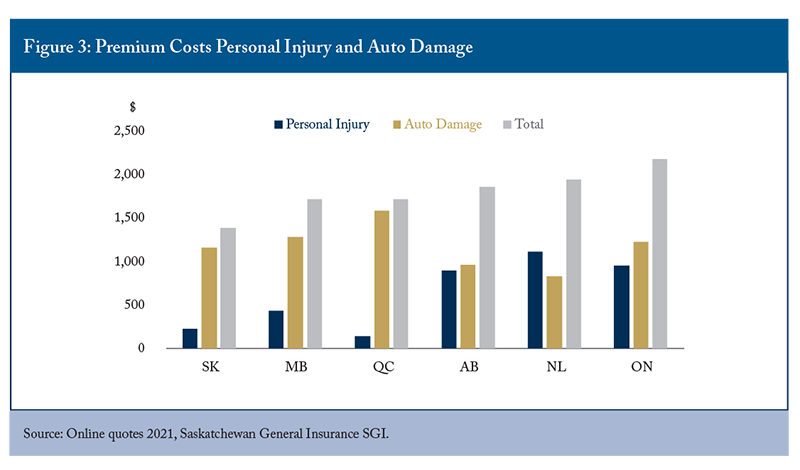

We further analysed the quoted premium into its main components – auto repair and personal injury. Where applicable, both coverages include an element of third-party liability except for Quebec and Manitoba, where no lawsuits are allowed for personal injury. Looking at each component provides better insight into what policy choices influence value and price (see Figure 3). We can see that auto repair coverage forms the majority of the premium in most provinces. However, the personal injury premium generally drives the overall ranking of cost.

Policy Choices – Coverage for Auto Repair or Loss of Automobile

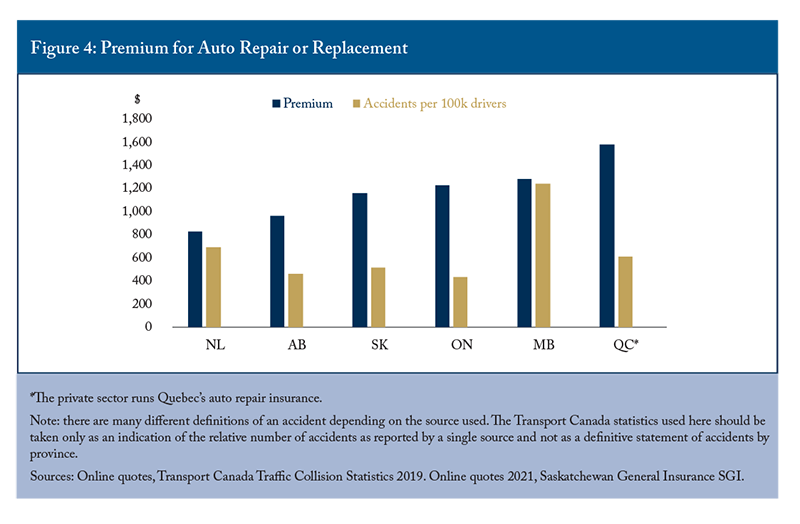

To better understand the comparative costs of auto loss or damage insurance, Figure 4 isolates this premium component from Figure 3.

Statistics Canada reports that Canada has some 45,000 businesses engaged in the broad category of automotive repair and maintenance.

Drivers understand that cars are getting more expensive to repair because they are more technologically advanced. However, fraud in auto repair – from towing companies and unprincipled repair shops – represents a notable portion of the cost of repair insurance. The Insurance Bureau of Canada, on its website, describes the various fraud scenarios in auto repair. While estimates of fraud in auto insurance are at best, informed guesses, there is widespread consensus in the industry that fraud constitutes a major issue in auto insurance. The IBC, on one occasion, estimated

One way to mitigate fraud in auto repair and ensure efficient and safe repairs is to deal with repair shops accredited under the Canadian Collision Industry Accreditation Program. To be certified, shops must follow sound business practices and meet strict standards for technician training. They must also invest in the (often expensive) specialized tools and training to do complex repairs and pass periodic inspections.

Saskatchewan and Manitoba are the only two provinces that deal exclusively with accredited repair shops. Looking at Figure 4, we see that Saskatchewan has an accident rate 20 percent higher than Ontario’s, but a slightly lower auto damage premium. Manitoba (the province with the highest rate of accidents in Canada for several years according to Transport Canada) has a lower auto damage premium than Quebec but has twice the rate of accidents. The average hourly wage for automotive mechanics in the four provinces is similar at about $28 an hour.

While some of Saskatchewan and Manitoba’s lower costs compared with those of Ontario and Quebec could be attributable to differences in sociological factors among the provinces, it is likely that using accredited repair shops has reduced fraud and contributed to their lower relative auto repair costs. A recent US study has identified another factor driving up repair costs: restrictive practices by the large auto manufacturers. A May 2021 report by the U.S. Federal Trade Commission found several such practices, including restricting parts to independent repair shops, designs that make independent repairs more complex, software updates not readily available to independent shops, and restrictive end-user license agreements. In addition, the FTC concluded that the evidence does not support manufacturers’ justifications for their repair restrictions. As a result, the FTC intended to pursue appropriate enforcement and regulatory options to increase competition and help consumers reduce the cost of repair.

Given the complexity of modern auto repair and the need to combat fraud, governments in Canada should seriously consider mandating the need for repair shops to be certified. Governments should also investigate whether the FTC findings apply for Canada, and if so address these restrictive practices.

Policy Choices – Coverage for Personal Injury

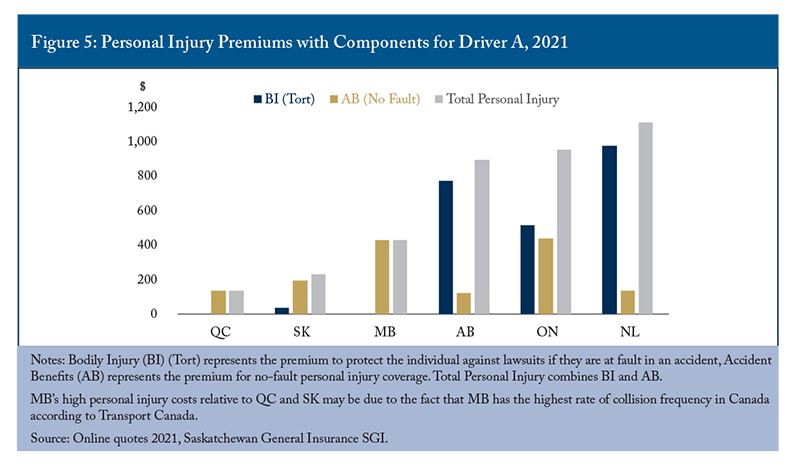

Figure 3 above shows that the premium for personal injury coverage is the most significant source of the overall price difference in the annual premium among the provinces. We further broke down the personal injury premium into the premium for tort coverage and no-fault coverage (Figure 5).

A pattern that becomes clear is that the higher the element of tort (lawsuits) for personal injury in a province, the higher the cost of personal injury coverage. Ontario appears to have relatively lower tort costs, but this is misleading since, as we shall see, Ontario’s no-fault benefits system has taken on many of the disputes and expenses of a tort system.

A January 2019 review of automobile insurance in Newfoundland and Labrador observed that consumers in that province were paying 35 percent more, on average, for private passenger automobile insurance than consumers in the other Atlantic provinces, primarily because of high bodily injury (tort) costs. (Newfoundland 2019). Prior to 2020, Newfoundland had no mandatory accident benefits. Starting in 2020, Newfoundland introduced a new mandatory no-fault accident benefit component to its insurance product and doubled the deductible for pain and suffering awards under tort in an effort to reduce overall claim costs.

As discussed, before changing to a no-fault system in 2021, BC had one of the most expensive insurance systems in Canada. BC’s high cost was not due to any inherent inefficiency in government administration – two independent reviews (Ernst and Young (EY) and Price Waterhouse Coopers (PwC)) concluded that BC’s administration costs compared very favourably to the Canadian industry. Rather, BC’s high costs were due to its heavy reliance on tort as a means of compensating accident victims.

There is a debate on the merits of allowing an injured person to sue a driver who is at fault under tort. However, the majority of injury management jurisdictions in Canada (for example, all the provincial workers’ compensation systems and the Quebec, Saskatchewan, Manitoba and now BC auto insurance systems) have found that the transaction costs of allowing tort outweigh the benefits for the system as a whole. For example, the Alberta government, in 2020, commissioned an expert panel to review options for fundamental changes to its troubled and expensive auto insurance system. The panel’s report observed that: “The historical review and evaluation of numerous commissioned reports over decades and across many Canadian provinces provided compelling evidence that traffic accident compensation models which retain tort features result in continuing premium instability in the medium and long term…. The optimal and only solution to produce long-term stability to auto insurance pricing is the replacement of the existing hybrid tort/no-fault model with a pure no-fault traffic accident care and compensation model.” (Alberta 2021). After several years of high costs driven mainly by its tort system, in 1995 Saskatchewan switched to a no-fault system

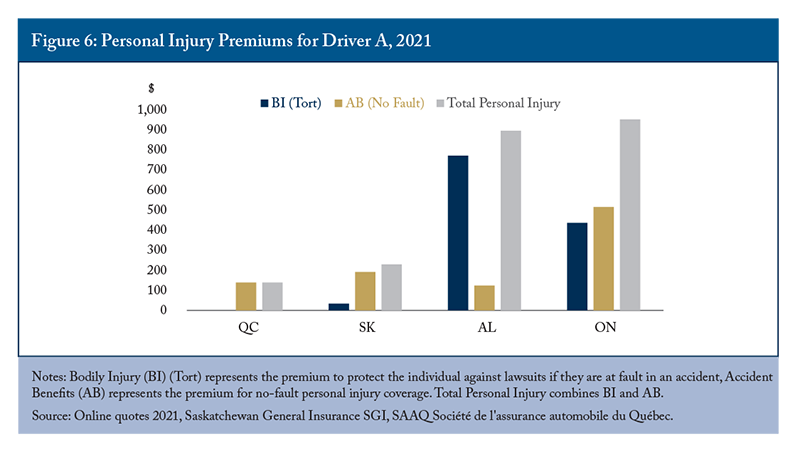

To better understand how product design affects price and value for personal injury insurance, we further examined the systems in Ontario and Alberta and compared them to the systems in Quebec and Saskatchewan (Figure 6).

The data clearly show that for personal injury coverage the government-run systems are many times less expensive than the private systems,

In the government-run systems, we did not find any evidence that their respective provincial governments were subsidizing their cost of healthcare.

Our analysis found that many of the factors in the private-sector delivery systems that negatively impact their value proposition stem from five identifiable faulty design features in the product. They are

- Open-ended, complex product design;

- A misaligned healthcare delivery system;

- Lump-sum cash settlements to claimants in lieu of paying for medical care;

- Excessive regulatory burden; and

- Inadequate provision for seriously or catastrophically injured victims.

Open-ended, complex product design: The private-sector provincial products all have open- ended goals in their legislation. Alberta and the Atlantic provinces have legislation that requires insurers to pay “all necessary and essential medical and rehabilitation costs”

To complicate matters, governments have added a mini social security net to the personal injury insurance product. For example, the no-fault insurance product in Ontario includes: income earner benefits and non-income earner benefits; attendant care benefits; lost educational fees if you are a student; expenses for relatives and visitors to visit the injured person; help with the costs of caring for a dependent; skills training; financial counselling; vocational training; the repair or replacement of some personal items lost or damaged in the accident, and more. Each benefit has its eligibility and duration criteria making the system complex and difficult to understand. The other private-sector delivery provinces have similar if somewhat less extensive benefits attached to their no-fault accident policies.

Finally, the private-sector product designs allow tort and requires private-sector insurers to go through the expensive and time-consuming process of defending lawsuits on behalf of their clients and pay cash settlements.

Open-ended policy goals and complex entitlements in a private-sector setting result in frequent disagreements on interpretation between insurers and claimants. Lawyers and experts are retained by both sides to resolve disputes often ending in cash settlements in lieu of providing medical care, even in the no-fault portions of the benefit scheme. Justice Douglas Cunningham commenting in 2016 on his review of the Ontario dispute resolution system put it this way: “the whole notion of getting benefits to deserving claimants quickly and inexpensively has been lost.”

In Ontario alone, the transaction costs of its faulty product design are huge. As reported in “Fair Benefits Fairly Delivered” (2017), approximately 30-35 percent of Ontario’s auto insurance cost of personal injury claims – some $1.4 billion a year, or $7 billion over five years – goes to pay for legal and expert opinion fees and not to injured parties. These transaction costs are a major contributor to Ontario’s high insurance premium.

The government-run systems in Quebec and Saskatchewan also have open-ended commitments in their legislation to restore the injured person to their pre-accident condition as far as possible. They also have extensive social safety nets built into their no-fault auto insurance products. But they have a decisive advantage in controlling costs that private-sector insurers do not have. The government agencies are Quasi-Judicial Administrative Bodies. Their decisions on entitlement are final and can only be challenged through a tightly prescribed appeal process. They do not enter into long-drawn-out disputes or negotiations with claimants, and they do not settle past or future claims for personal injury coverage with lump-sum cash settlements. And of course, lawsuits for medical benefits are either not permitted at all (Quebec, Manitoba) or in limited circumstances (Saskatchewan).

In the private-sector delivery provinces, the open-ended promises and complex nature of entitlements of the government-designed insurance product and the presence of lawsuits drive a high level of disputes and costs, negatively impacting their price/value propositions.

Misaligned healthcare delivery structure: Private-sector healthcare insurers know how to deal with defined-benefit entitlements. They pay medical costs based on billings from providers within defined limits per individual and per treatment with yearly maximums. This process is known as passive management of healthcare. While there is nothing in the legislation requiring them to do so, the major private-sector auto insurers in all the private-sector provinces have carried passive healthcare management into their auto insurance claims management approach. Auto insurance legislation, however, demands that the client be returned to their health condition before the accident and provides for maximums in the tens of thousands of dollars. The result is a misalignment of the delivery structure to the goals of the insurance policy.

The government auto insurance agencies in Quebec, Saskatchewan and Manitoba (and all of the provincial workers’ compensation agencies) follow what is known as an active healthcare management strategy for their clients. While clients are free to choose their healthcare provider, the government agencies follow up closely with clients and medical providers to ensure that treatments are evidence-based and contribute to the injured person’s recovery. If a person is not recovering within an expected timeframe, the patient gets an independent, expert assessment of what further treatment would most benefit them. Active healthcare management enables the agencies to ensure that treatments are evidence-based and helps prevent runaway medical costs and fraud. It also helps clients recover quickly and avoids simple injuries from developing into permanent impairments.

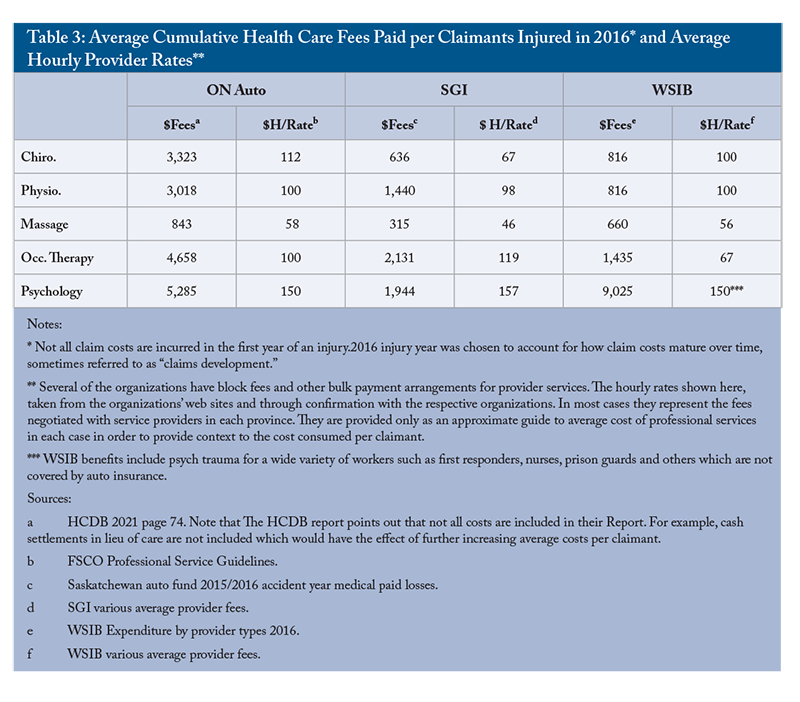

Passive management of healthcare, on the other hand, exposes private-sector auto insurers to paying for overtreatments, unnecessary treatments, and potential fraud. For example, Ontario’s Workers Safety and Insurance Board (WSIB), which actively manages healthcare, receives about 200,000 injury claims a year from workers who have either lost time or not lost time from work and spends approximately $600 million

Table 3 shows the average cost insurers pay per claimant for medical services that account, according to the Ontario Health Claims Data Base (HCDB), for 90 percent of the medical care for auto insurance claimants in Ontario. The equivalent cost per claimant is shown for the WSIB and Saskatchewan auto insurance systems, both of whom exercise active healthcare management. The data show (Table 3) that Ontario auto insurers, with their passive management approach, pay double or triple the average cost per claimant for the same types of injuries and treatments, compared with Saskatchewan General Insurance (SGI) or Ontario’s WSIB, even after accounting for differences in provider fee rates. This would indicate that either Ontario insurers are being billed for major volumes of unnecessary treatments per claimant or for treatments that were not delivered.

There is clear evidence that insurers’ passive management of healthcare in the private-sector delivery provinces exposes them to significantly higher costs with negative impacts on their value propositions.

Lump-sum cash settlements in lieu of medical care: Cash settlements for personal injury claims (tort claims plus cash settlement of disputed no-fault claims) form the majority of personal injury claim payments in the private-sector delivery systems. As discussed earlier, the open-ended nature of the policy goals opens the door for disputes over entitlements to personal injury benefits, which are frequently resolved through cash settlements to close the claims. After hiring lawyers and experts to get a cash settlement, there is no guarantee that the recipients obtain the healthcare they need. The government-run auto insurance systems do not offer lump-sum cash settlements. Unfortunately, cash settlements bring with them exposure to fraud and claims exaggeration. In recognition of the seriousness of the issue, in Ontario, the Ministry of Finance and FSRA have launched a joint effort to create a Fraud and Abuse Strategy for the Auto Insurance Sector.

There is also evidence that provinces that settle healthcare claims in cash have a higher propensity for clients to file claims relative to auto accidents than provinces that do not settle healthcare claims in cash. Notably, Dr. Cassidy et al. (2000)

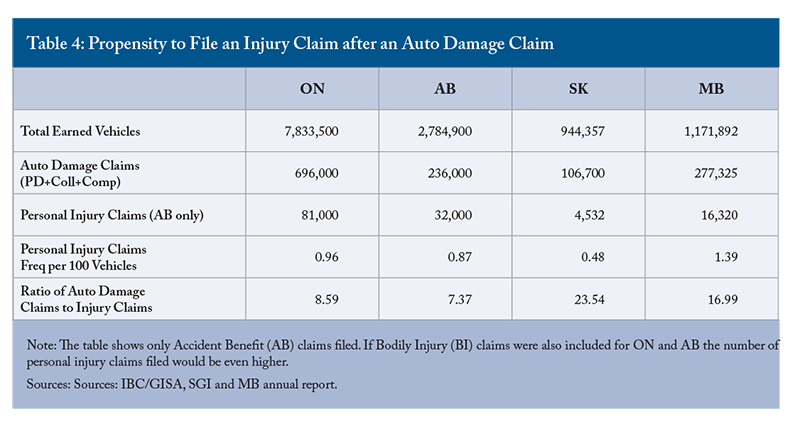

Where we were able to gather data, we compared the propensity to file a personal injury claim in Saskatchewan and Manitoba, which do not offer cash settlements in lieu of medical care, with Ontario and Alberta, which do offer lump sum cash settlements for injury claims (see Table 4).

The data show that individuals involved in accidents in provinces which offer cash settlements are two to three times more likely to file a personal injury claim after an accident than in the provinces which do not offer cash settlements. Cash settlements also expose private-sector insurers to fraud and exaggeration.

Regulatory burden: In addition to instances of poor product design, governments impose a significant regulatory burden on private-sector insurers in several cases. Governments require prior approval of premium rate changes and restrict the products private-sector insurers can offer, even on an optional basis. Governments control the risk criteria insurers can use in pricing their products and restrict their profit margins. Governments impose “take all-comers” rules, caps on minor injuries and entitlement to pain and suffering awards. They introduce a grid system that sets a maximum premium that insurers can charge young drivers or drivers with poor driving records. They impose rate reduction orders and caps on premiums from time to time. As Alberta found, when governments intervene to contain costs, they decouple premiums from underlying costs. Insurers react by reducing availability. When governments ease restrictions to improve availability, premiums rise unless there is some fundamental change in the cost of claims. Significantly, governments stifle innovation. Canada is a laggard in introducing new products compared to the US or Europe

With one of the most expensive systems, Ontario has long been the province with the heaviest government intervention ostensibly aimed at reducing cost and improving value. Yet, tellingly, in its 2019 budget,

To be fair, the Financial Services Regulatory Agency (FSRA) in Ontario, formed in 2019 to replace the previous auto insurance regulatory body, has been active in reducing regulatory burden to the extent they can. For example, in 2019, FSRA introduced a fast-track rate approval process if the rate increase being requested by the insurer is 5 percent or less in any one year (that has sped up approvals considerably), a review of the “take all comers rule” in Ontario is underway, and it recently announced the formation of a unique innovation initiative designed to help insurers implement new ideas. Still, there is a long way to go to significantly reduce regulatory burden across the private-sector auto insurance delivery systems including Ontario.

The regulatory burden in the private-sector systems adds significant complexity and compliance costs and negatively impacts competition and innovation.

Inadequate provision for severely or catastrophically injured victims: The majority of auto injuries are soft tissue sprains and strains. Ontario’s Health Claims Database

Private-sector delivery provinces spend hundreds of millions of dollars annually on medical care for injuries, the majority of which, according to the FSCO study, require minimal to no medical attention. By contrast, the insurance schemes in the private-sector provinces, except for Ontario, offer no additional compensation to a victim who is seriously or catastrophically injured. Ontario offers $1 million in special compensation for a catastrophic injury. While more generous than the other private-sector delivery provinces, after paying hefty lawyers fees this amount can still be inadequate to sustain catastrophic victims for the rest of their lives.

The government-run insurance systems in Quebec and Manitoba offer unlimited lifetime medical and related benefits for catastrophically injured victims while Saskatchewan offers up to $7,500,000, and so does BC under its new no-fault system starting in 2021. Similarly, the workplace injury insurance systems in all of the provinces

offer lifetime medical care to catastrophically injured workers.

Judge Robert Kopstein, in his 1988 Report (Manitoba Autopac Review Commission), expressed it this way: “Minor injuries are disruptive and uncomfortable, but not tragic. It is, in my opinion, the potential to be injured critically and disabled permanently that motorists should most fear. It is for that eventuality that insurance should make uncontested access to an acceptable level of compensation available.” On this score, the private-sector delivery systems fall considerably short.

For all the billions spent each year by private-sector insurers on personal injury compensation, disputes, delays, and high costs, the private-sector delivery systems in Canada are overcompensating minor injuries and under compensating severe and catastrophic injuries, which negatively impacts the value proposition.

The Best Delivery Option – Government vs Private Sector

The government-run systems we examined, Quebec, Manitoba and Saskatchewan, are financially stable and provide good value. There is no evidence that governments are directly subsidizing their insurance agencies. There are good fundamental reasons for their lower cost base, particularly for personal injury coverage. Among them, the fact that they are single-payer empowered agencies that pursue active management of healthcare and do not have to cope with tort claims. However, government auto insurance agencies have negative features that are not responsive to market demands. For example, government auto insurance agencies do not have to make a profit, which insulates them from consumer demands. Governments can waive prudentially advisable capital reserve requirements, hence allowing their agencies to operate at lower premium levels compared to equivalent private-sector companies. As well, because there is an implied government financial backstop, government agencies can sometimes carry deficits, as several of them have, for years. This allows the agencies, mostly under pressure from governments, to effectively subsidize the cost of their insurance policies in times of rising prices. When the agency eventually reduces its costs or raises rates to recover their deficits the burden falls on future policy holders. This may take many years and mask underlying price distortions. The Quebec auto insurance agency SAAQ experienced a twenty-year period 1984-2004 during which the government refused to allow the agency to raise insurance premiums despite the increase in costs resulting in annual deficits which were only recovered after the government segregated the insurance funds in 2004 into a separate trust fund and allowed the scheme to be run on a more financially sound basis.

BC has experienced similar government interference in recent years. From 2017 to 2020, the Insurance Corporation of British Columbia (ICBC) saw its year-end equity plunge from a surplus of $3.1 billion to negative $557 million

As well (though it also happens by government decree in the private-sector systems), government agencies have features that cross-subsidize costs from more-risky to less-risky drivers. They also offer less consumer choice and are more susceptible to distortions through government interference. While the government systems we examined can keep their premiums for personal injury insurance low, they are in effect over-insuring their drivers. Lifetime medical care and substantial wage protection are likely overkill except for very seriously injured claimants, given the social safety nets that already exist in all provinces.

On the other hand, as we have explained, we don’t have a truly private-sector auto insurance product to compare with the government-run systems. We have considerable government interference in the private-sector auto insurance market. In effect, the advantages of private-sector market forces have been sacrificed for other government priorities. This situation robs consumers of good value for their insurance dollars. Fortunately, it is unlikely to last.

The financial services industry is undergoing significant changes. Non-traditional competitors are entering the field to offer insurance and other financial products to suit consumer needs. Some of them, like auto manufacturers Tesla and Volkswagen are already offering bundled auto insurance with the sale of their cars in certain markets. Large tech companies are likely to follow suit to leverage their large customer relationships.

The international Open Banking initiative,

Many consumer product suppliers, including auto insurers in the UK, are experimenting with dynamic pricing, changing their prices based on certain conditions such as usage, time of day, or customer demand. In Canada, the Insurance Bureau of Canada reports that Canadians cannot buy auto insurance policies for which the monthly premium automatically reflects their changing driving habits while consumers in the United States and Europe can buy such policies.

The nature of the automobile itself and transportation is rapidly evolving and so are financial markets. The future world is not well suited to government-operated or government-designed consumer services. Over the next few years, governments are likely to come under considerable pressure from consumers who want more customization and product variety to surrender their monopolies on providing auto insurance and control over product design.

Policy Recommendations for Governments with Private-Sector Auto Insurance Systems, Urgent Product Reform Needed

At one level, one could argue there is no real need to mandate that every driver carry personal injury insurance. Provinces already have extensive healthcare and income support safety nets. The governments of the UK, for example, and several US states do not require drivers to carry any personal injury insurance on a mandatory basis.

On the other hand, if it is not insured, dealing with the extra cost of an auto injury falls on the injured person. Tens of thousands of motorists and accident victims in provinces across Canada file claims under personal injury auto insurance coverage every year. Auto insurance is a secondary payer of personal injury costs. It pays for only the portion of personal injury cost that is not already covered by any other insurance policy in place, for example, the provincial healthcare system or employer-based healthcare systems. It suggests that personal injury coverage in auto insurance does carry value for consumers. Importantly, absent a no-fault component, compensation for personal injury damage enters fully into the domain of tort law and, experience has shown, favours some and not others and becomes much more expensive.

We do not recommend that the private-sector provinces switch to government delivery systems, including for personal injury insurance to capture cost savings. Even if successful, despite the cost and risks involved, it would be solving yesterday’s problem. The future of consumer services, like insurance, lies in being responsive to rapid changes in consumer needs in features including pricing and innovation, all qualities which governments are poorly suited to deliver.

It is entirely possible to reform the private-sector product to yield billions of dollars of savings for consumers and make auto insurance more responsive to market forces in Canada. Our principal recommendations are outlined below.

Third-Party Liability Coverage: This exists in all provinces today but ranges from $50,000-$500,000. A person who is seriously injured, exhausted their no-fault benefits and tries to recover costs from an at-fault driver might find the liability coverage carried by the driver, for example, $50,000 significantly inadequate. Suing the at-fault driver for their personal assets may also yield little additional benefit. The mandatory third-party liability coverage should be increased to $1 million across all provinces to protect the driver and potential claimants who may be seriously injured.

A Simple Mandatory No-Fault Personal Injury Policy that Does Not Over-promise: The personal injury policy should provide a specified number of medical treatments for specified types of injury listed in the policy. Injuries and treatments not on the list are not covered. Governments can set the exact parameters based on medical advice. As we have seen, a limited number of injury types cover all claims by 90 percent of claimants. The policy should have limits for the number of treatments and the total cost of each type of treatment based on sound medical evidence.

All other social security benefits currently included in the no-fault accident benefit policies should be removed and made available as optional benefits to be purchased according to consumer choice. The no-fault personal injury policy becomes simplified and focussed on medical care only.

Given the findings in the FSCO report on common traffic injuries, an overall policy limit of $65,000 would be more than generous to cover medical care for the vast majority of auto injuries, including the costs associated with the less frequent types of injuries such as spinal fractures, internal injuries and multiple injuries not covered by the provincial healthcare systems. The Ontario Health Claims Data Base shows that the average medical cost per claimant for non-minor injuries is about $14,500.

Access to routine care for the majority of injuries would require a treating physician’s recommendation and would have defined limits. However, access to care above a minor injury limit must be supported by an independent evaluation center’s recommendation (see below). The insurer must follow the advice of the independent evaluation center. Competing medical evaluations must not be allowed, and there must be no lump sum cash settlement for medical care.

The no-fault personal injury policy should provide generous medical support with unambiguous benefits and eligibility criteria. Competing medical opinions must be avoided. There should be no lump sum cash settlements in lieu of medical treatment. Additional insurance features can be purchased as consumer choice options.

Independent Evaluation Center: A fundamental element of delay and extra cost in private-sector delivery systems is caused by the inability of parties to agree on an appropriate diagnosis and treatment of an injury. If a patient is not recovering from initially planned treatment, all the successful government injury management systems refer the patient to an independent medical center or team for assessment. The assessment is done fairly early in the process, usually about 60-90 days after injury. The goal is to catch impediments to recovery early, get them looked after, and avoid escalation. The independent medical assessment reviews the patient’s medical record pertaining to the injury, is in touch with the patient’s treating physician, and examines the patient in person. The examination establishes a diagnosis and provides recommendations on the best treatment options to facilitate recovery. If the patient is still not fully recovered after following the recommended treatment, a second assessment is undertaken if necessary, involving more specialized physicians. The role of the examinations is forward-looking and geared to helping the patient recover. They are not concerned in any way with approving or denying a claim.

The government delivery systems maintain a roster of competent, independent medical examiners to carry out this role. For example, Saskatchewan designates selected clinics across the province to perform the assessments, and the WSIB in Ontario refers patients to hospital-based interdisciplinary medical teams. Importantly, the government agencies accord significant deference to the recommendations of the independent examiners and rely on them to make final decisions on the care for an injured person.

Governments with private-sector insurance delivery need to establish a similar, independent, highly competent and multi-disciplinary team of medical examiners along the lines described. In both no-fault and tort cases, the medical examiner’s opinion must be treated as binding, or at least given significant deference before courts. Duelling medical opinions by experts must not be allowed.

There can be no cost-effective private-sector auto insurance system without an objective way to bring finality to the assessment of the individual’s medical condition in an injury claim. It’s that important.

Increased No-fault Payments for Catastrophic Injury: One of the key issues is how to insure a driver against catastrophic injury. The government auto insurance systems provide this as part of their auto insurance policies. In Australia, iCare, the workers compensation system of New South Wales, offers lifetime care to auto accident victims on a no-fault basis if they are very severely injured.

A second option would be to significantly increase the amount of compensation available on a no-fault basis to serious or catastrophically injured victims.

Based on the opinion of the independent evaluation center, if a person is catastrophically or very seriously injured, governments in private-sector insurance delivery systems should make suitable arrangements for their lifetime care. Alternatively, they should receive a substantial one-time settlement, (for example, potentially up to $5 million) depending on their age and degree of impairment. The exact amount of compensation can be set based on an analysis of comparable court settlements in each province and updated periodically. The compensation should include an element to recognize the loss of quality of life. The insurer must make a prompt settlement without obliging the claimant to retain legal counsel.

Restrictions on the Ability to Sue an At-fault Driver: The ability to sue an at-fault party under tort for additional benefits has posed significant cost problems for private-sector delivery systems. There is no way to avoid some element of tort in a private-sector system since private-sector insurers cannot offer lifetime, unlimited care, nor is it necessary to do so. Ontario imposes a limitation on the right to sue for general damages to those individuals who have suffered a serious and permanent impairment and whose damages exceed a certain monetary threshold. The proposed reforms in this report offer generous no-fault medical coverage and a significant provision for catastrophic or severe injury.

It would be reasonable for governments to restrict the right to bring a tort action to only the most severe cases. For example, if the victim is very seriously injured and the at-fault driver is guilty of gross negligence or driving under the influence.

Protection Against Damage to the Automobile: Insurance against damage to or loss of an automobile should be an optional purchase for the driver, based on personal choice. In addition, governments must evaluate whether auto manufacturers are engaging in anti-competitive practices driving up repair costs, and require insurers to use certified repair shops to help ensure safe repairs and minimize fraud.

Remove/Reduce the Regulatory Burden: There is no point in accessing private-sector insurers for delivery of auto insurance and then handcuffing them with an excessive regulatory burden. Instead of involving themselves in every aspect of the product, governments should reduce regulatory burden and allow the market to operate as freely as possible. In the UK, there is no regulatory control over product pricing. The Insurance Research Council in the US published a study in 2012 (Tennysson 2012)

Conclusion

Auto insurance is mandatory in all provinces and an important pocketbook issue for most Canadians. How the insurance product is designed and delivered affects its price and the value it delivers. Among the provinces, those who provide auto insurance directly through a government agency appear to provide better value for money, particularly for personal injury coverage, than those with private-sector delivery. However, the higher costs for personal injury coverage in the private-sector provinces is not because private-sector insurers are making excess profits. The main reason for the challenges in the private-sector delivery provinces is the faulty design of the insurance product which governments have imposed on the private sector as well as excessive government regulation.

There is no valid reason why governments should perpetuate the expensive and wasteful auto insurance regimes they have designed in the private-sector delivery provinces. Sensible solutions exist that will save consumers substantial sums each year, reduce disputes and provide substantially better value. It is entirely possible to reform the private-sector product. The recommendations in this report, if implemented, can yield billions of dollars of savings for consumers and make auto insurance more responsive to market forces in Canada.

References

Alberta Automobile Insurance Advisory. 2021. Available at: https://www.alberta.ca/automobile-insurance-reform-committee.aspx

Campbell, Alister, and Farah Omran, 2021. The Price of Protection: Benchmarking Canada’s Property and Casualty Industry Against its Global Peers. Commentary. Toronto: C.D. Howe Institute. Available at https://www.cdhowe.org/sites/default/files/attachments/research_papers/mixed/Commentary_601.pdf

Cassidy, J.D., et al. 2000. “Effect of eliminating compensation for pain and suffering on the outcome of insurance claims for whiplash injury.” N Engl J Med. 342(16):1179-86.

Cote, Pierre, et al. 2015. “Enabling Recovery from Common Traffic Injuries.” Available at: https://www.fsco.gov.on.ca/en/auto/documents/2015-cti.pdf

Federal Trade Commission (FTC). 2021. “Nixing the Fix: An FTC Report to Congress on Repair Restrictions.”

Financial Services Commission of Ontario. SCO Examination Results. Available at: https://www.fsco.gov.on.ca/en/service-providers/pages/2016-sp-compliance-rpt.aspx

FSCO Professional Service Guidelines. Available at: https://www.fsco.gov.on.ca/en/auto/autobulletins/2009/Documents/a-04_09-2.pdf

General Insurance Statistical Agency (GISA). 2020. “Private Passenger Accident Benefit Claims for Medical and Rehab.” Available at: https://www.fsrao.ca/media/4661/download

The Insurance Bureau of Canada (IBC). Canadian Loss Experience Automobile Rating CLEAR data base. Available at: http://www.ibc.ca/pe/auto/buying-auto-insurance/how-auto-insurance-premiums/clear

___________. 2021. Health Claims Database. (HCDB). Available at: http://www.ibc.ca/ab/resources/industry-resources/data-management/stat-plans/hcdb-(health-claim-reporting)

___________. 2020. “2020 Facts of the Property and Casualty Insurance Industry in Canada.” IBC Public Assets. Available at: http://assets.ibc.ca/Documents/Facts%20Book/Facts_Book/2020/IBC-2020-Facts.pdf

____________. “Updating Insurance Regulations.” Available at: http://www.ibc.ca/ab/the-future/updating-insurance-regulations

Insurance Corporation of British Columbia (ICBC). 2020. “The Future of Auto Insurance in Canada.”

__________. 2017. “Affordable and Effective Auto Insurance-A New Road forward for British Columbia,” 10 July 2017 EY. Available at: https://www.icbc.com/about-icbc/company-info/Documents/Affordable-and-Effective-AutoInsurance-Report.pdf

Kelly, Mary, et al. 2014. “The Impact of Regulation on the Availability and Profitability of Auto Insurance in Canada.” Available at: https://papers.ssrn.com › sol3 › papers

Manitoba Autopac Review Commission. 1988. Report by Judge Robert Kopstein. Available at: http://pam.minisisinc.com/scripts/mwimain.dll/144/PAM_AUTHORITY/AUTH_DESC_DET_REP/SISN%201748?sessionsearch

McCandless, Richard. 2021. June 25. Available at: https://www.bcpolicyperspectives.com/media/attachments/view/doc/commentary_icbc_profits_june_2021/pdf/commentary_icbc_profits_june_2021.pdf

____________. 2021. “Tracing ICBC’s Missing $400M in Capital Build Funds.” Posted April 30.

Marshall, David. 2017. “Fair Benefits Fairly Delivered. A Review of the Auto Insurance System in Ontario.” Ontario Ministry of Finance. Available at: https://www.fin.gov.on.ca/en/autoinsurance/fair-benefits.html

Newfoundland and Labrador. 2019. Board of Commissioners of Public Utilities Review of Automobile Insurance. January 29.

Ontario Automobile Insurance Anti-Fraud Task Force. 2012. Available at: https://www.fin.gov.on.ca/en/autoinsurance/final-report.html

Ontario Budget, 2019: https://budget.ontario.ca/2019/chapter-1b.html#section-3

Open Banking in Canada website. Available at: https://obicanada.ca/

Tennysson, Sharon. 2012. “The Long-Term Effects of Rate Regulatory Reforms in Automobile Insurance Markets 2012.” Insurance Research Council.

Transport Canada. 2019. “Traffic Collision Statistics online quotes.” Available at: https://tc.canada.ca/en/road-transportation/statistics-data/canadian-motor-vehicle-traffic-collision-statistics-2019

WSIB Ontario report. 2020. “By the Numbers 2020.” Available at: https://www.wsib.ca/en/bythenumbers