From: Cyrille Schwellnus and Michael Koelle

To: Bill Morneau, Minister of Finance

Date: June 30, 2020

Re: Supporting incomes while promoting a speedy labour market recovery

In response to the jobs crisis triggered by COVID-19, a number of countries, including Australia, Japan, New Zealand and most of Western Europe, have established or expanded job retention schemes to preserve as many existing jobs as possible.

These typically aim to subsidize businesses to preserve existing job matches while workers experience only limited wage losses. Other countries, including a number in Central and Eastern Europe and the United States, have taken very limited job preservation measures, and instead expanded unemployment insurance. Firms in these countries have greater incentives to lay off workers in response to the COVID-19 shock.

Canada has resorted to elements of both approaches by establishing the Canada Emergency Wage Subsidy (CEWS) scheme and the Canada Emergency Response Benefit’s (CERB) $2,000 a month (taxable) for laid off workers.

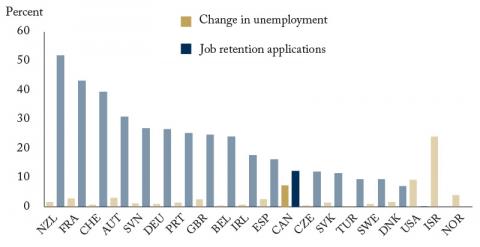

In our recent OECD paper, we found that changes in unemployment and applications to job retention schemes suggest that increases in unemployment have typically been smaller in countries with larger coverage of applications (Figure 1). At least in the short term, job retention schemes appear to have been effective in limiting increases in unemployment.

Canada has experienced a fairly large increase in unemployment, which may reflect the fact that CEWS uptake, though not insignificant, has so far been far less substantial than CERB. The relative ease of layoffs compared to most Western European countries may also be playing a role.

A rapid return to work will require strengthening financial incentives for workers. Policymakers will need to tread a fine line between maintaining exceptional income support for workers who cannot return to work and ensuring that work for returning workers actually pays. This could be achieved by gradually reducing the generosity of exceptional income support while expanding support for earned income.

In Canada, for instance, the generosity of the CERB could gradually be reduced while temporarily expanding the Canada Workers Benefit (CWB), a refundable tax credit that complements earnings for low-income earners. Given that the CWB increases as workers earn more, this may strengthen incentives for workers to move from struggling industries to those with better growth prospects where full-time jobs may be more readily available.

Supporting a rapid return to work will also require strengthening incentives for firms to hire workers. This could, for instance, be achieved by introducing hiring subsidies, including for previously dismissed workers once economic conditions improve.

In Israel, the government introduced a recall subsidy of around $2,100 (US) at the end of May. To limit the risk that job retention schemes or recall subsidies lead to inefficiently low levels of reallocation, employers’ contributions to the cost of job retention schemes may need to be raised from the low levels put in place during the acute phase of shutdowns.

In Canada, a first step would be to phase out the full refund of employer social security contributions for complete furloughs in the CEWS. Moreover, access to training and restrictions on combining income from short-time work schemes with income from other jobs could be eased to allow workers to seize new job opportunities as they arise. In Canada, firms that benefit from the CEWS but reduce workers’ monthly wages could be required to proportionally reduce working time, which would allow workers to take part-time jobs or participate in training.

Cyrille Schwellnus is a Deputy Head of Division and Michael Koelle is a Junior Economist in the OECD Economics Department.

To send a comment or leave feedback, email us at blog@cdhowe.org.

The views expressed here are those of the authors. The C.D. Howe Institute does not take corporate positions on policy matters.